African Development Bank Group and Private Infrastructure Development Group team up to scale-up domestic capital mobilization across Africa

The African Development Bank Group and the Private Infrastructure Development Group have agreed to work together to unlock long-term local currency capital for energy, infrastructure, industrialization, housing and other productive sectors across Africa.

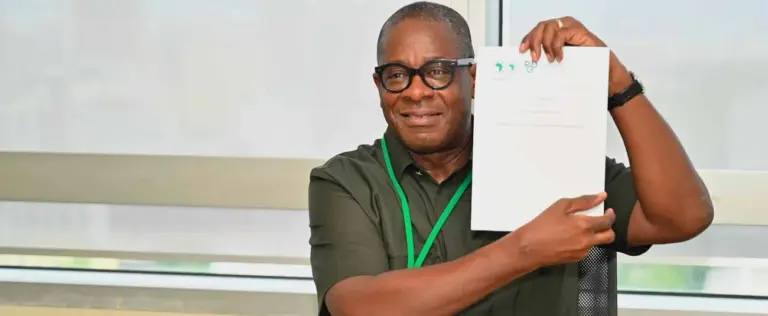

The agreement was signed on 14 May at the Bank’s headquarters in Abidjan by Solomon Quaynor, African Development Bank Vice-President for Private Sector, Infrastructure and Industrialisation, and Philippe Valahu, Chief Executive Officer, Private Infrastructure Development Group.

The collaboration aims to develop de-risking and credit enhancement solutions to tap into Africa’s vast pool of domestic capital – including sovereign wealth funds, pension schemes, insurance assets, and other savings vehicles – estimated at over $2 trillion. This initiative takes on added urgency amid ongoing global economic and political uncertainty.

The two institutions are building on successful joint work in Nigeria and East Africa through Infracredit Nigeria and the Dhamana Guarantee Company. These models have shown how credit guarantees can unlock local currency investment and deepen domestic capital markets.

“The African Development Bank is focused on making Africa’s capital work better for Africa’s development. In this regard, we are pleased to extend our long-standing complementary partnership with the Private Infrastructure Development Group in jointly scaling up the establishment of new onshore credit enhancement facilities to mobilize domestic capital in a transformational manner across Africa,” said Vice president Quaynor.

Valahu hailed the partnership as critical to obtaining greater access to local finance.

“At PIDG we believe that mobilising Africa’s vast domestic capital is one of the most powerful and sustainable ways to accelerate inclusive growth and infrastructure development. This partnership with the African Development Bank marks a significant milestone in our joint commitment to scaling proven credit enhancement models that unlock long-term local currency financing and deepen capital markets across the continent,” he said.

The pact aligns with the African Development Bank’s new Ten-Year Strategy (2024– 2033) to transform African economies, and with both institutions’ commitment to drive infrastructure development, industrialization and resilient economic growth in Africa.

https://www.afdb.org/en/news-and-events/press-releases/african-development-bank-group-and-private-infrastructure-development-group-team-scale-domestic-capital-mobilization-across-africa-83809