Eaglestone and Partners Secure Financing Milestone for the Lobito Atlantic Railway

Eaglestone has announced the signing of the key financing agreements for the Lobito Atlantic Railway Project in Angola, a significant milestone for one of the region’s most strategically significant transport corridors. Eaglestone acted as Co-Financial Adviser, alongside Africa Finance Corporation, to Lobito Atlantic Railway S.A. (LAR), the borrower and concessionaire, and its sponsors—Mota-Engil, Trafigura, and Vecturis—whose combined technical, operational and commercial expertise underpins the long-term success of the corridor.

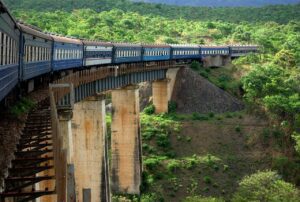

The Lobito Atlantic Railway is a flagship regional infrastructure project that will rehabilitate, upgrade and operate the strategic 1,300-kilometre brownfield rail line connecting the Port of Lobito on Angola’s Atlantic coast to the Democratic Republic of Congo border. The project is designed to strengthen regional integration and improve access to global markets, particularly for mineral-rich economies in Central and Southern Africa.

The US$753 million financing package reflects strong international and regional backing. It comprises US$553 million from the U.S. International Development Finance Corporation and US$200 million from the Development Bank of Southern Africa. Beyond trade and logistics, the project is expected to deliver significant development impact, including job creation, skills development, improved safety standards and long-term economic opportunities for communities along the corridor. Once operational, the railway is expected to increase Lobito’s transport capacity tenfold to approximately 4.6 million metric tonnes per annum and reduce the cost of transporting critical minerals by an estimated 30 per cent.

“We are delighted to have advised LAR in this landmark transport infrastructure transaction that is a key milestone to unlock regional trade and boost economic activity along the Lobito Corridor,” said Nuno Gil, Founding Partner of Eaglestone. “The Eaglestone team can be proud of once again delivering world-class services within the project finance advisory industry in Southern Africa.”

From a regional development perspective, Africa Finance Corporation highlighted the broader strategic importance of the project. “The signing of the financing agreements for the Lobito Corridor Railway reflects the strength of AFC’s financial advisory capabilities in structuring and advancing complex, cross-border infrastructure transactions of strategic importance,” said Samaila Zubairu, President and CEO of AFC. He added that the project reinforces the critical role of integrated rail and port infrastructure in unlocking regional trade, industrial growth and supply-chain resilience, while underscoring AFC’s long-standing commitment to Angola’s infrastructure and economic development priorities.

For the sponsors, the agreement marks the culmination of long-term collaboration. Manuel Mota, Deputy CEO of Mota-Engil, said the signing with DFC, DBSA and the Government of Angola will “expand transport capacity, reduce transit costs, and open access to the mineral-rich regions of the Democratic Republic of Congo and Zambia,” adding that the financing “reinforces confidence in Angola’s institutional capacity to attract interest for world-class infrastructure initiatives.”

Trafigura also emphasised the railway’s strategic value. “As a shareholder of LAR, we see the railway as a key domestic and regional asset that will drive economic development and support the movement of critical metals to global markets,” said Richard Holtum, CEO of Trafigura.

With the financing now secured, the Lobito Atlantic Railway moves into a critical delivery phase, positioning the corridor as a cornerstone of regional connectivity, industrial development and global market access for Angola and its neighbours.